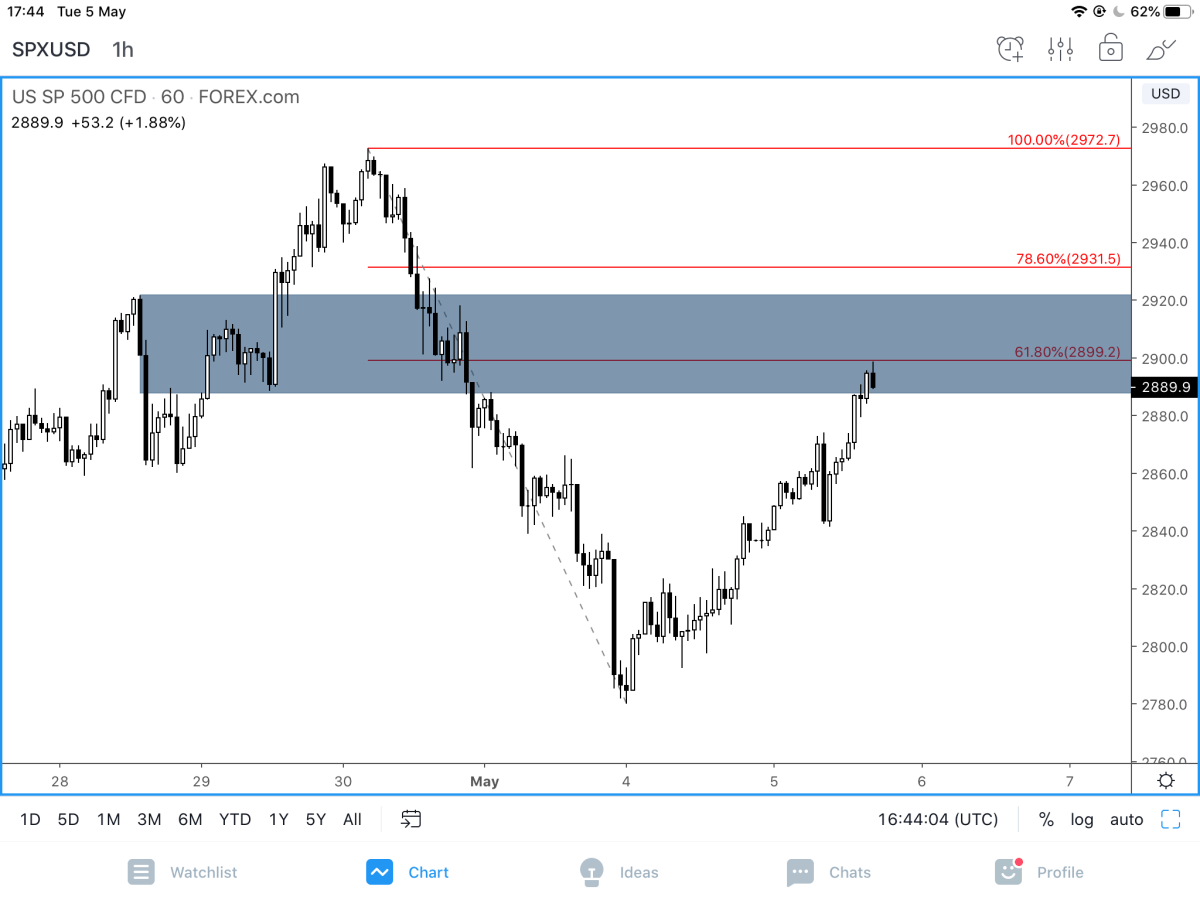

Last week all the major indices created inverted hammer candles like this on the S&P 500:

If you look at Nasdaq, DAX, Russell you will see similar setups.

So, IF those were the bearish reversal candles and after this week’s bounce back into resistance range, then we should be looking for bearish setups.

The SPX has now reached between 61.8 – 78.6% retracement against last week’s high. Similarly the Nasdaq has also reached its 61.8 fibo.

This is a somewhat aggressive way of looking for a short trade setup. So, keep the risk small if you do enter around such levels because although we have the weekly bias we don’t have a daily bearish bias yet.

Better and easier opportunities will present themselves if we break last week’s lows.

But in terms of risk to reward entering around these levels is by far more favourable than waiting for the breakdown.

If you want to learn how I turn these analysis ideas into actual trade ideas, subscribe to my premium trade signals service.

impressive technical analysis