The USD/CAD may be about to resume its bearish trend, thanks mainly to ongoing weakness or the US dollar and the rebound for crude oil boosting the appeal of the Canadian dollar.

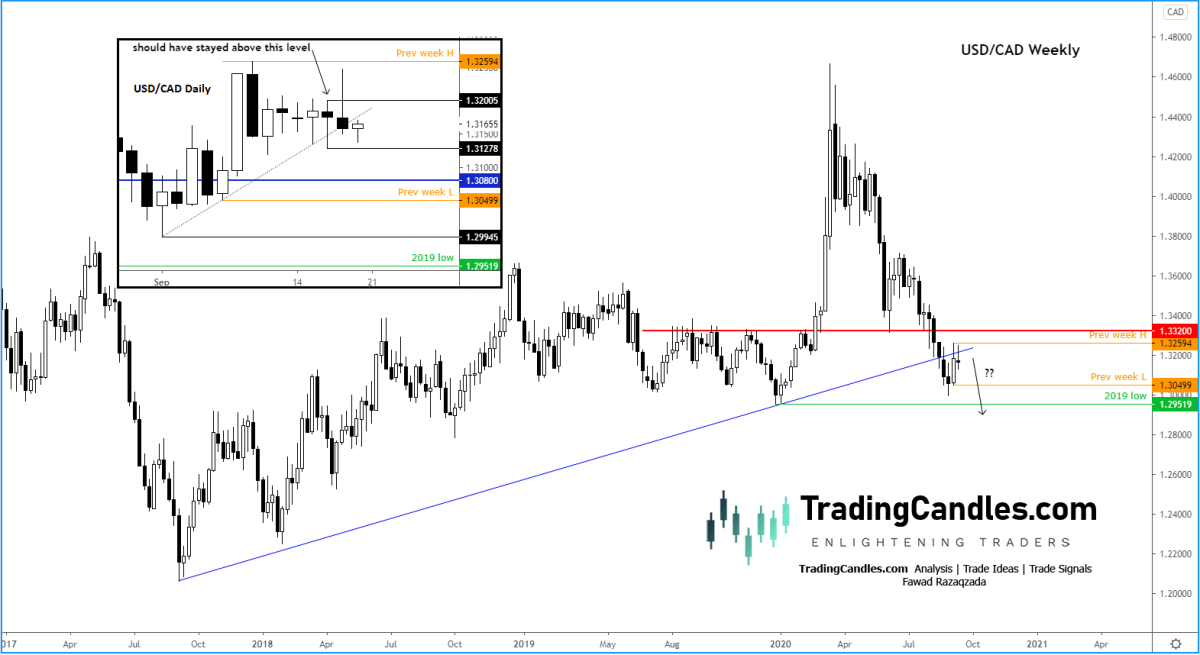

More to the point, there was a technical failure for the USD/CAD to hold its breakout above the key 1.32 handle on Thursday:

Prior to Thursday, the Loonie had formed several bullish-looking candles as the bulls tried to add to last week’s gains. However, the breakout attempt failed, which means the bulls are potentially trapped. Additional pressure has come from the underside of the long-term broken trend line.

So how do you trade this?

Well, if the bulls are indeed trapped, where do you think rates will be heading to next? That’s right, to locations where trapped bulls will have their stop loss orders placed. One such level is beneath Thursday’s low at 1.3127. The next one is beneath last week’s low at just below 1.3050. Those could be our targets.

A break above Thursday’s high will prove me wrong, so that’s the invalidation level for me.

The trigger for entry could be the re-test of short-term resistance level or a breakdown in short-term price structure on the lower time frame such as the 5-60 min chart. I will leave that part to you 🙂

If you want to learn how I turn my analysis reports and videos into actual trade ideas, subscribe to my premium trade signals service