Much has been said about the US 10y yields breaking out and a lot of focus will be on that ahead of the FOMC decision tonight. But It is not just the US where bond prices are slumping. Yields are rising across the major developed economies as this chart shows:

Today, German 10y yields are also breaking out of the triangle:

This is causing the German-Japan 10-year yield spread to widen:

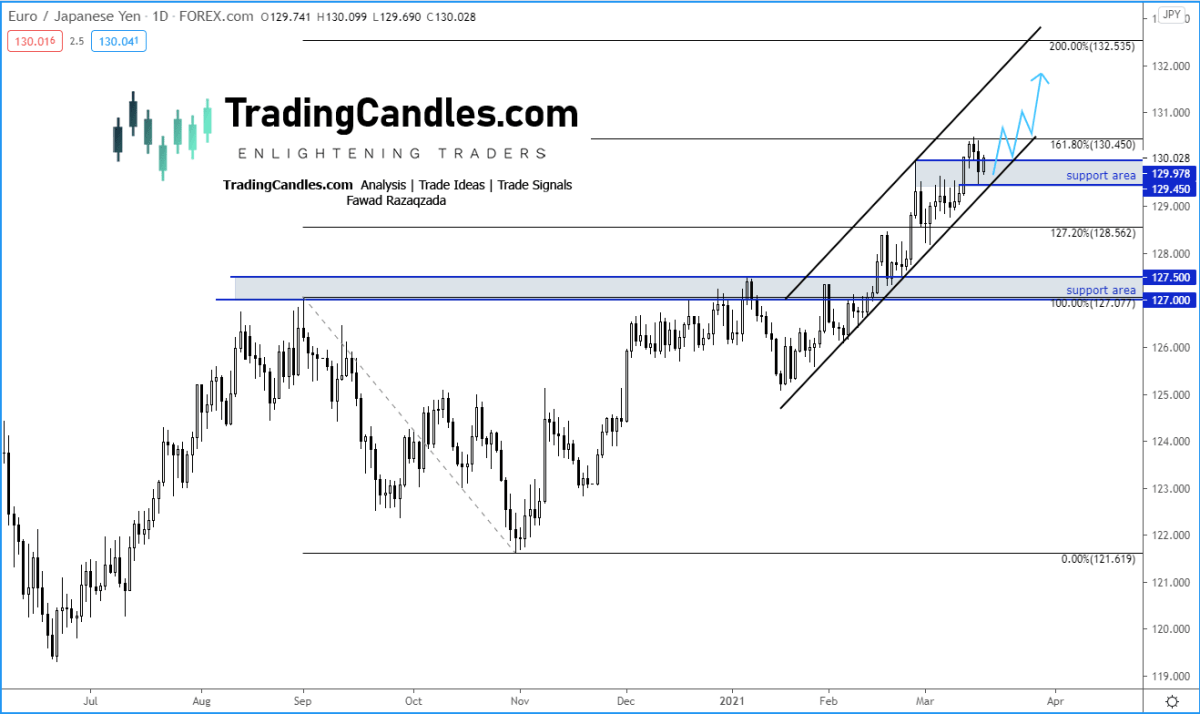

Given the rising German yields and the widening of the German-Japan yield spread, the EUR/JPY should be able to continue higher from the support area shown on the chart:

We have had great success with the EUR/JPY for the private group in the past, for example THIS one:

This was an even better trade on EUR/JPY I provided for the private group in February:

Let’s hope the good run of form continues for the EUR/JPY and judging by the price action on the yield charts that’s how it is looking like at the moment.

If you want to learn how I turn my analysis reports and videos into actual trade ideas, subscribe to my premium trade signals service